The recent drop in oil prices, caused due to an unprecedented increase in oil supply does not bode well for countries like USA and Canada, where the very oil extraction process is much more costly as compared to countries like Saudia Arabia, Iraq, Iran and the Middle East.

With virtually no reaction from OPEC, it is expected that the “cash cost is the only true floor” as predicted by Morgan Stanley analyst Adam Longson.

Cash cost is basically the break even cost needed to keep the oil production running, which does not include any profit or government budget projection.

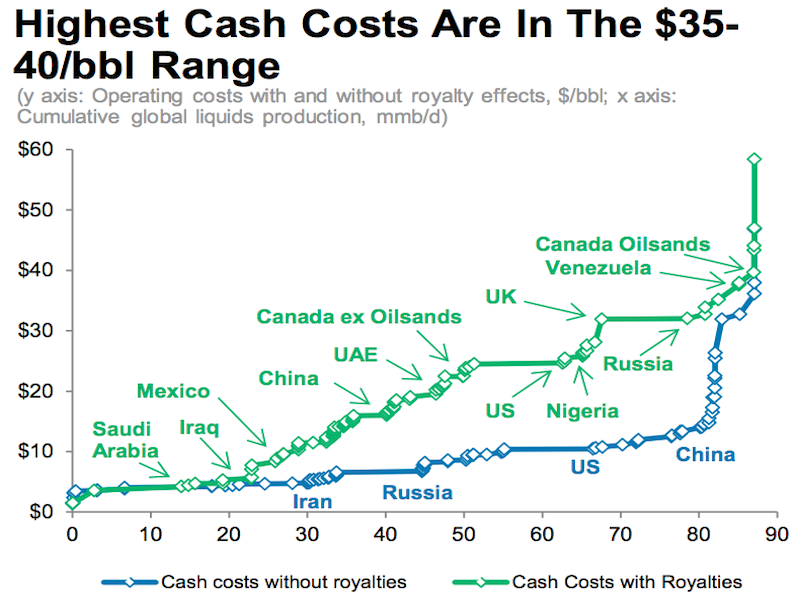

The solution to this dilemma is not merely lowering or reducing the oil supply rather as Adam Longson pointed out “In commodities without a cartel, existing production must be shut-in. If true, marginal cost of investment is not the relevant metrics, it’s variable operating cost, which is closer to $35-$40/bbl on the high end.”

The chart shown below, displays the cash costs for oil production around the world. It is a comprehensive summary of what countries, if left unchecked, will the rapidly falling oil prices affect the most.

|

| Morgan Stanley |

Contributed by