Table of Contents

ToggleExtract from an article written by Deloitte centre of financial services“How financial services industry can make IOT technology pay-off”

The project, fielded during July 2015, involved more than 50 analysts across 20 countries.

EXECUTIVE SUMMARY

Financial services have long trafficked in the intangible, from counterparty risk and online bill payment to things that used to be tangible but increasingly are not any longer, such as stock certificates and even money itself. So all the talk about the Internet of Things (IoT)—a suite of technologies and applications that provide information about, well, things—might not seem directly relevant to the way financial services institutions (FSIs) do business.

But the IoT may be as broadly transformational to the financial services industry as the Internet itself, and leaders should make an effort to recognize the opportunities and challenges it presents for the financial sector as well as for industries with which FSIs work closely.

Notwithstanding the inevitable hype, many industries see great promise in IoT applications: Analysts and technology providers forecast added economic value of anywhere from $300 billion to $15 trillion by this decade’s end.1 Few analysts seem to expect anything but a transformative effect on just about every dimension of economic activity by 2020. The IoT—based on the concept of physical objects being able to utilize the Internet backbone to communicate data about their condition, position, or other attributes—is likely going to matter a great deal. (For an overview, see Deloitte University Press’s “Internet of Things” collection of articles.) And FSIs can be active participants in this transformation.

ANALYZING THE NEARER-TERM POTENTIAL

FSIs are already using IoT technology to measure and analyze those elements of their business that are directly tied to data about tangible thing—driving habits, health, and so on. Therefore, we see the IoT’s near-term potential in financial services as largely defined by how these existing “tangible” applications may spread. To identify possibilities, one approach would be to consider deployments of sensors of all types and analyze which of these might yield information that could be useful—even tangentially—to the various businesses within the financial services industry. In a sense, since sensors are the IoT’s most physical element, we can use them as a stand-in to measure IoT applications as a whole.

In a recent report, Gartner forecast that, on a worldwide basis, “endpoints of the Internet of Things will grow at a 32.5 percent CAGR from 2013 to 2020, reaching an installed base of 25.0 billion units.”Covering more than 200 different categories of sensors, across consumer, business, and vertical-specific categories, the forecast suggests a broad expansion of deployments between now and the decade’s end. Undoubtedly, deployment of 25 billion new endpoints should create considerable business opportunities for companies of all types.

About the project

The insights in this section on future IoT scenarios are based in part on a crowdsourced simulation exercise conducted by Wikistrat on behalf of the Deloitte Center for Financial Services. The project, fielded during July 2015, involved more than 50 analysts across 20 countries. These analysts had varied backgrounds, including technology entrepreneurs; business and technology leaders within the financial services industry; academics with doctorates in economics, business, and technology; analysts in government and research centers; and cybersecurity consultants.

The project was designed to explore the IoT’s long-term potential in financial services. Wikistrat tasked analysts with developing a series of use cases within six specific industry sectors, and with forecasting and describing the opportunities and challenges that IoT technology presents (see exhibit 3 of the appendix for a full list of the scenarios).

They followed a structured process that included the following steps:

Using an online tool, analysts worked collaboratively to develop 44 use-case examples using a wiki-based template designed to identify IoT-related trends and issues, potential opportunities, and risks and challenges.

They then provided a quantitative assessment of the probability that each use case will emerge and its overall impact or importance to the industry.

Wikistrat and the Deloitte Center for Financial Services then reviewed all cases and probability assessments to select 10 use cases for further development.

At a final workshop, participants reviewed and enriched the short list of 10 cases. Enrichment activities included clarification of use cases, provisioning of additional data points, reinforcing potential value for FSIs, and identification of cross-cutting themes and issues.

The sheer number of ideas our workshop generated in a short period suggests that opportunities to capitalize on new information flows may be limited only by our collective imagination.

What might be possible?

A few of the workshop’s more interesting use cases provide a glimpse into a future of new opportunities and threats for incumbents, emerging technology–based financial services companies, and regulators alike. Some overall themes emerged from this exercise.

In brief, these include:

The emergence of what the panel called “radical transparency” may undermine advantages that come today from information asymmetry. This is particularly true in investment and lending businesses, in which equity analysts, loan officers, and others make decisions based on their unique perspectives.

Data associated with individual (and corporate) preferences and behaviors will likely be at the center of new opportunities and disruptions to the incumbents’ business models.

Risks of various types can emerge along with the opportunities. Protecting data privacy and security should be of paramount importance, especially for financial institutions. But unintended consequences may emerge from automated processing of huge volumes of near real-time data flows. Fraudsters could seek to intercept this information to manipulate markets, or operational disruptions could occur if automated decisions are made based on faulty data or inaccurate analysis.

The ability to access IoT-generated data will likely be a challenge for many firms, which may result in the emergence of a new class of service providers, offering data “subscription” services in the manner of credit bureaus or market data providers. Again, whether it makes sense for the owners of these data to offer this intelligence for public consumption will be driven by many factors, such as whether or not these data provide a competitive advantage to the owners within their own businesses.

The project also yielded some broader implications for the industry at the sector level. These are presented in turn below.

Banking

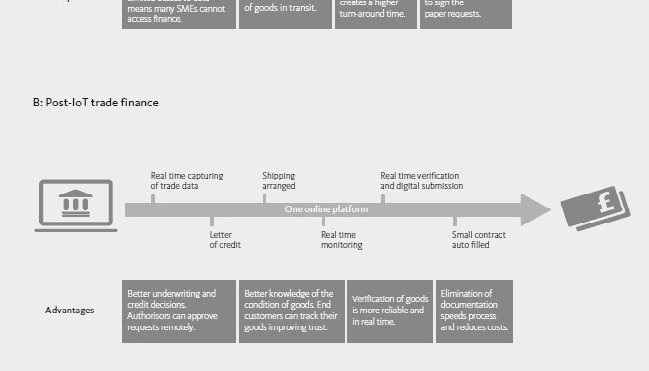

The analysts imagined that IoT applications might help banks improve underwriting processes and reach new markets. They foresaw that physical, performance, and behavioral data generated from biometric and positional sensors for individuals, and shipping and manufacturing control sensors for businesses, could provide new opportunities for credit underwriting, especially for those underserved customer segments lacking a credit history. The challenges here involved developing an understanding of which kinds of data are best predictive of creditworthiness, as well as the potential risk of new forms of redlining based on so-called “pattern of life” (POL) analyses.

Given that banks finance the lease or purchase of many physical items, our Wikistrat panel found opportunities for banks to tap into data from sensors monitoring these goods’ condition to offer customized solutions. For example, lenders could partner with electronics and “white goods” manufacturers to proactively make credit offers to individuals if their purchased items begin to show noticeable wear or face imminent failure. Leasing companies, too, could monitor the condition of leased assets in order to determine a more precise residual value of the asset at lease expiration, or determine with greater accuracy any discounts or penalties for preferred or unacceptable use.

Capital markets

Analysts considered IoT-enabled opportunities to further automate trading and investing activities, driven by continued acceleration in algorithmic trading and the enhancement of this approach through the application of IoT sensor data. The group considered the possibility that, with the removal of the human element in combination with more comprehensive real-time data flows, firms could develop analytics that might better evaluate suspected market bubbles. Others were less sure: While efficiencies would certainly be gained, intelligent agents might be unable to account for shifts in consumer demand or geopolitical events, and thus faulty conclusions could in turn actually create a bubble. There was consensus, however, on the need for firms on both the buy and sell sides to help improve their capacity and capability to gather, store, and analyze huge amounts of real-time, IoT-generated data.

Taking it a step further, crowdfunding and micro-investing opportunities could emerge based on based on analysis of investor behavior. New capital pools could therefore emerge, potentially with new and different systems of rewards. The Wikistrat report suggested that this could significantly shift the way venture capital is sought.

Insurance

The longer-term impact of the adoption of automotive sensors emerged as one of the more interesting scenarios for insurance carriers. Already, the industry is grappling with the strategic implications of self-driving cars, suggesting a shift from automobile casualty insurance, where the driver is at fault, to product liability insurance, where the manufacturer may be held liable.20 Insurers may gain better information on product-design defects to more accurately price coverage but face the potential evaporation of significant amounts of premium income as accident rates drop and traditional coverages fade away.

A more interesting implication concerns augmented behavior: Usage-based insurance itself may lead to policyholders demanding more on-demand coverage to reduce their costs. For example, in personal life and injury insurance, all manner of risks are covered under a single policy, but with the development of more fine-grained data about personal behaviors, firms could fine-tune coverages to potentially add or eliminate certain risks. In essence, insurance coverages could be unbundled and “decommoditized” to create differentiation from other products in the marketplace. This would make underwriting and pricing a more complex undertaking, but could yield improved customer satisfaction.

On the commercial side, deployment of sensors on shipping containers and transport vehicles may provide insurers with the opportunity to enhance shipping insurance coverage. The ability to better detect and model risks due to theft or damage could move the pricing of these products from an actuarial exercise to one that better assesses risks and losses in real time, while at the same time enabling insurers to more accurately determine responsible parties. In essence, IoT technology could go a long way toward eliminating “proxies” in the risk-assessment process much more broadly than the initial forays seen in telematics today.

Investment and wealth management

The Wikistrat analysts identified ways that investment managers could benefit from modeling the “enthusiastic crowd.” Firms could utilize information from a client’s IoT “ecosystem” to tailor investment decisions and asset allocation based on behaviors, preferences, and location. For example, a more intimate understanding of a client’s interests and purchasing patterns could enhance wealth management. Investment offerings could be tailored based on these data, leading to the extension of concepts similar to socially responsible investing. This analytical approach could also potentially provide a more accurate modeling of investor risk tolerance as well, a part of new-account onboarding that firms have traditionally given lip service through execution of a simple survey. In the new, IoT-enabled world, companies could develop algorithms relying on inputs of POL-based behavioral data to provide a more accurate picture of a new client’s true risk tolerance than a response on a questionnaire.

The analysts also explored the possibilities associated with automating portfolio management. Assuming that firms can address existing constraints around data availability, they could combine real-time data flows from a variety of sensors with cognitive technologies and M2M communication to automate fund management far beyond what is seen today, as with index funds. This could lead to increased differentiation between types of investment management firms, funds, and pricing strategies. Active managers may be forced to specialize in a particular strategy or sector, while automated managers leverage an ability to synthesize huge amounts of data, combined with high-frequency trading technologies, to act faster than any human can today.

Commercial real estate

The emergence of real-time bidding markets in commercial real estate was another scenario the panel of specialists envisioned. Already, tech startups have emerged to create more transparency in the process of finding and leasing commercial space.21 With IoT technology, firms could combine data from sensors used to manage building energy and security with activity sensors that monitor the level of human interaction within common areas, on elevators, and in the surrounding neighborhood. In this way, analysts could value properties even more accurately. These data flows, if exposed to a public marketplace, could in turn create a kind of trading market, reducing friction in the leasing or buying processes as well as giving investors greater transparency as to property values.

Design and construction of commercial and residential properties could benefit from behavioral analysis as well as the monitoring of construction equipment and materials, some panelists believed. Developers could take advantage of the increasing interest in combined “live/work/play” developments by analyzing foot traffic and other POL indicators to fine-tune their building plans. And engineering and construction firms might be better able to manage projects’ safety and efficiency based on wider deployment of connected construction vehicles and smart asset tags.

Risk management in FSIs

Finally, the analysts envisioned “quantified self ” concepts as a way to potentially reduce risk and improve performance. For example, companies might better manage conduct risk by monitoring FSI employees’ stress levels, patterns of movement, and other factors as a way of predicting the potential for internal fraud. Multi-factor authentication in both virtual and real environments could better flag identity theft. For example, retailers could authenticate online chip-enabled payment-card transactions by matching the presence of the card to other physical objects (such as a mobile phone, or even wearables) that are known typically to be within close proximity to the payment device.

Portfolio managers could also improve their performance by understanding how they react during times of stress. Clearly, employees may resist being monitored so closely, but for those in positions of particular importance, such data gathering, kept private and secure, may become a requirement of employment.

MAKING SENSE OF IT ALL AND TAKING ACTION

Firms should begin planning for this new source of data. As recently as 2012, slightly less than 15 percent of FSIs—and less than 10 percent of insurance carriers—were implementing or planning to implement IoT or M2M-based solutions or applications. Firms should start exploring potential impacts and opportunities related to the deployment of IoT technologies, and begin strategizing on how to capitalize on these developments, using the Information Value Loop as a guide. Developing strategic partnerships with IoT innovators across the spectrum, including related technologies such as cognitive computing, will aid understanding of where the market may be headed.

Early experimentation, building off of existing deployments, will help firms with a test-and-learn approach. Certainly, insurance carriers and firms in the commercial real estate industry have a leg up here, but banks may be able to capitalize on the connections between mobile payments, wearables, and sensing devices. Beyond that, firms could start with the assumption that every single object in the day-to-day lives of both customers and employees will soon be able to share data. From that starting point, take an art-of-the-possible approach by identifying the potential opportunities these new data streams could create for them. Indeed, they could consider going beyond test-and-learn, and instead take an approach that embraces the notion of “learn fast, fail fast.”

On a more tactical level, however, firms will need to pay attention to the operational side of the opportunities they may identify. The avalanche of IoT-generated data will dwarf firms’ current data volumes, threatening to overwhelm already-inadequate strategies and technologies in place to manage and capitalize on these data. Accommodating this increased data flow will not come cheap: Both data management and analytical capabilities will require a quantum leap forward. And firms may need to rely on new information brokers to manage and allow centralized access to these data if they are to be of any benefit.

Even though, for most FSIs, the presence of a physical thing is absent from the products they offer and the operations they maintain, the industry is increasingly informationcentric at its core, and has plenty of hard-won experience in information management.

Firms that get ahead of this trend will likely be at an information advantage, where faster, better, and cheaper insight can create opportunities for improved customer experience and operational performance. In many ways, the opportunity for FSIs can be to de-commoditize products and services that are differentiated based on their command of these data flows. Regardless of which of the scenarios imagined above emerge, the stark reality is that an increasingly large percentage of the physical world will be connected to computing power of one kind or another, and we’re only at the beginning of what could be a vastly different world from what we see today. Reflecting back on Kevin Ashton’s vision that computers may someday be able to see, hear, and smell the world for themselves, it could be argued that financial services has a built-in advantage.

Recent Comments